October 13, 2015

Reference Data Poses Significant Challenges for the Capital Markets, Study from Accenture and Greenwich Associates Shows

Regulatory changes and data-quality issues are driving costs higher

LONDON; Oct. 13, 2015 – The majority of capital-markets firms say that data quality and regulatory changes are impacting costs and driving firms to examine replacing siloed data-management systems, according to a global study of buy- and sell-side professionals conducted by Accenture (NYSE: ACN) and Greenwich Associates.

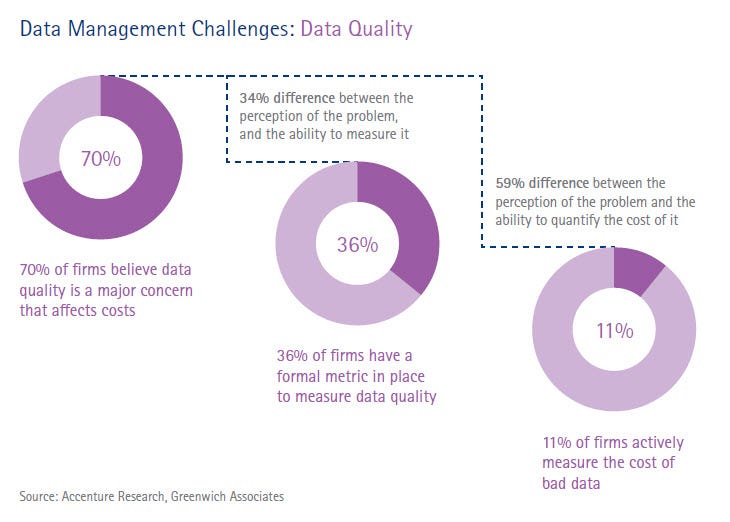

In the study of 133 front-, middle- and back-office executives in capital-markets firms, more than two-thirds (70 percent) of respondents ranked data quality as a top issue affecting their trading infrastructure, and nearly half (47 percent) said they find it difficult to deliver solutions that meet these challenges.

“Management of reference data remains a big challenge for the capital markets industry,” said Owen Jelf, global managing director of Accenture’s capital markets business. “Though capital-markets institutions spend more than $6 billion a year on reference data, the industry continues to operate on legacy systems that often don’t align, and data comes from multiple sources, in disparate formats that require continuous data cleansing and reconciliation. Firms would benefit from focused end-to-end multiple year investment in developing ways to make meaningful, holistic changes to fix this problem.”

In capital markets, reference data refers to financial data that is generally focused on major categories common across many processes, such as: instrument reference data; end-of-day pricing data; corporate action notifications; client and counterparty data; internal organization data; and other shared static data such as calendars, currencies, countries and regions.

The study identified four key themes among all respondents: data-quality issues continue to plague the industry; costs of managing reference data continue to rise; regulatory requirements are driving increasing burdens and adding to costs; and firms continue to struggle with the need to balance streamlining business operations while responding to a rapidly changing business environment.

Though the study identified a variety of factors for rising reference-data costs, one of the main challenges institutions face is the growing regulatory burden. Nearly half (47 percent) of respondents said they are struggling to meet regulatory requirements, yet only slightly more than one-third have a formal regulatory change program in place (36 percent) or have a standardized approach to dealing with regulatory change (37 percent).

When asked to cite internal and external factors affecting costs, more than one-third of respondents said they expect to see an increase in operating costs (cited by 36 percent of respondents) and IT costs (37 percent) over the next 12 months. The study also found that, on average, data licensing continues to make up 33 percent of capital-markets firms’ overall spend, and 41 percent of the respondents said they expect that number to grow as data demands rise and providers become stricter with licensing.

“The world’s leading capital markets firms can save millions of dollars each year by embracing a mutualization model or a utility to manage securities reference data,” says Dan Connell, Managing Director and head of Market Structure and Technology at Greenwich Associates. “A utility for reference data management can enhance the settlement process, lower costs, and speed up compliance to ongoing regulatory pressures and enable firms to focus on what they do best.”

Please visit Accenture or Greenwich Associates to learn more.

About Accenture

Accenture is a global management consulting, technology services and outsourcing company, with more than 358,000 people serving clients in more than 120 countries. Combining unparalleled experience, comprehensive capabilities across all industries and business functions, and extensive research on the world’s most successful companies, Accenture collaborates with clients to help them become high-performance businesses and governments. The company generated net revenues of US$31.0 billion for the fiscal year ended Aug. 31, 2015. Its home page is www.accenture.com.

# # #

Media Contact:

Damon Leavell

Accenture

+ 1 917 452 4083

[email protected]

Francois Luu

Accenture

+ 33 1 53 23 68 55

[email protected]