April 19, 2018

Pension Benefits Are Critical Factor for Workers – Regardless of Age – in Deciding Whether to Accept a Job, Accenture Survey Finds

Public- and private-sector workers in North America demanding greater access to retirement-planning tools through digital channels

ARLINGTON, Va.; April 19, 2018 – Pension benefits are a major factor for most workers in North America when deciding whether to accept a job, according to results of an Accenture (NYSE: ACN) survey released today. The research found that millennial workers are the most interested in pension benefits and also identified a strong but underserved demand for retirement coaching and planning tools through digital channels.

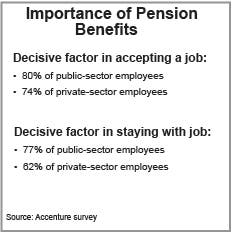

Nearly four in five (78 percent) of the 2,750 U.S. and Canadian workers and retirees with pension plans surveyed said that the availability of pension benefits was a critical factor in deciding whether or not to accept a job. Further, pensions remained a critical loyalty factor even after employees were hired, with nearly three-quarters (73 percent) of respondents saying they stayed with an employer due to pension benefits.

The survey found that pension benefits are relatively more important to younger workers than older workers, with 82 percent of millennials (ages 20-37) and 81 percent of Gen Xers (ages 38-52) citing the benefits as a critical factor in accepting a job, compared with 74 percent of baby boomers (ages 53-71).

"The pension benefit may now be nearly as important to employees as their healthcare," said Owen Davies, who leads Accenture’s global pension practice. "While health benefits have been the benefit most valued by job seekers and employees in recent years, pensions appear to be closing the gap."

Employees Want More Retirement-Planning Help

The survey, which focused on retirement planning, found that most current and retired employees said they want more help with retirement planning (cited by 82 percent of all respondents) and retirement coaching (84 percent). Younger workers are the most interested, with nearly nine in 10 millennials citing an interest in retirement planning (88 percent) and retirement coaching (86 percent).

Half (49 percent) of currently active employees said their employer offers retirement education or coaching, and one-third (32 percent) said their employer does not, with the remainder (approximately 20 percent) uncertain if their employer offers such services. But overall, most current and retired workers — 77 percent — said they wanted more knowledge and understanding of their retirement options.

Underserved Demand for Digital Channels

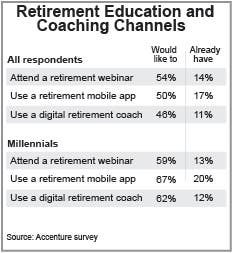

The survey found a strong but generally underserved interest in the use of digital communication channels for retirement information. For instance, more than half (54 percent) of respondents said they would like to attend a webinar for retirement education, but only 14 percent have done so. Similarly, half (50 percent) of respondents said they’re interested in using a mobile app to receive retirement info, while only 17 percent have been able to do so, and almost half (46 percent) said they would like to use a digital retirement coach, with only 11 percent served in this way. Interest in digital channels for retirement information is especially strong among millennial workers (see chart).

Implications for Employees and Employers

As a result of the findings, Accenture makes several recommendations for employers:

- Acknowledge the importance of pension and retirement benefits – Employers should ensure that their HR strategies acknowledge that pension and retirement considerations are critically important to job seekers and current employees and ensure that they address employees’ strong appetites for retirement information and support.

- Build awareness of benefits – One in five respondents (20 percent) didn’t even know if their employer offered retirement planning or coaching. Given rising concerns among older workers regarding the security of their retirement, it’s important that employers strive harder to provide their employees — and retirees — with the information necessary to help them manage their retirement.

- Leverage digital channels – Although few workers currently use digital communication channels for information and support on pension benefits and retirement planning, these channels apparently provide a lot of appeal, especially among younger workers. Therefore, employers should bolster their digital offerings to meet the demand from potential recruits and current workers.

"We see growing opportunities for employers to address unmet demands for digital channels and strong appetites among employees for more information and support regarding pensions and retirement planning," Davies said. "How pension benefits are shaped and how they are communicated to employees is very important to an organization’s effectiveness, stability and outlook. Our survey findings point to several areas that employers should focus on to attract and retain their employees."

About the Research

Accenture surveyed 2,750 U.S. and Canadian workers and retirees with pension plans (2,600 in the U.S. and 150 in Canada), of whom 1,790 were current workers and 960 were retirees. Three-quarters (2,050) of the respondents were from the public sector and one-quarter (700) were from the private sector. The online survey was conducted in November 2017.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With approximately 442,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

# # #

Contact:

Joe Dickie

Accenture

+1 512 694 6422

[email protected]