May 09, 2018

Insurers Must Reskill and Reshape Their Workforces to Seize Growth Opportunities from Artificial Intelligence, According to Research from Accenture

Investing in human-machine collaboration could boost insurance revenues 17 percent and employment 7 percent over next five years

NEW YORK; May 9, 2018 – Insurers risk missing major growth opportunities unless CEOs take immediate steps to redesign work, bring in new talent, and pivot their existing workforces to work with artificial intelligence (AI), according to new research by Accenture (NYSE: ACN).

The report, Future Workforce Survey - Insurance: Realizing the Full Value of AI, found that insurers that invest in AI and human-machine collaboration at the same rate as top-performing businesses could, over the next five years, boost their revenue 17 percent and their employment 7 percent, on average.

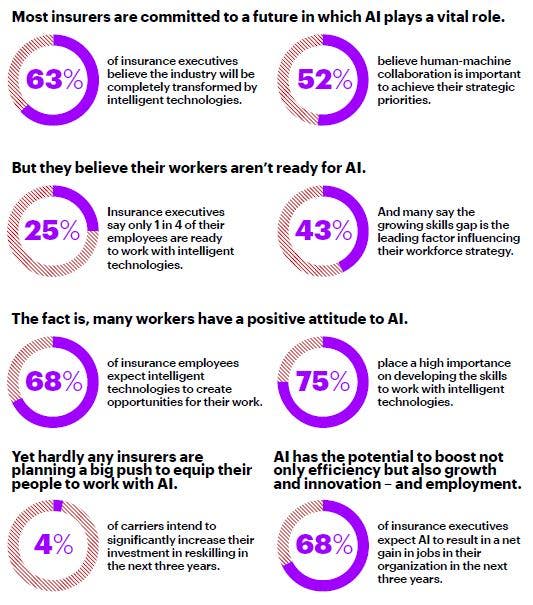

According to the report – based on two surveys, one of 100 senior insurance executives and another of more than 900 non-executive insurance workers – more must be done to train the insurance workforce to collaborate effectively with AI. For instance, the executives surveyed believe that only one in four of their workers are ready to work with AI, and more than four in 10 (43 percent) cite a growing skills gap as the top factor influencing their workforce strategy. Despite the clear need for training, only 4 percent of insurers plan to significantly increase their investment in reskilling programs in the next three years.

“AI has the potential to boost innovation, growth and efficiency, but insurers’ hesitance to properly reskill their employees could limit its impact,” said Michael Costonis, who leads Accenture’s Insurance practice globally. “To complicate matters, despite having a business that is ripe to apply technology and innovation, insurers aren’t in a good position to win the war on technology talent. Executives need to think pragmatically about how they can bring new talent in, redesign jobs and reskill existing employees appropriately. Creating a more-flexible work environment could be a key first step to attracting data scientists and other outside talent.”

A majority (61 percent) of the executives surveyed expect that the workforce of the future will be a blend of humans and machines. Contrary to the popular belief that AI will reduce jobs, two-thirds (67 percent) of insurance executives expect AI to result in a net gain in jobs within their company in the next three years.

The report found that insurance workers are willing to embrace AI in their day-to-day roles. Two-thirds (68 percent) believe it will create opportunities in their work, while only 4 percent think it will create more challenges. Almost three-quarters (73 percent) believe it will make their jobs simpler, and more than two-thirds (69 percent) believe it will enable a better work-life balance.

Reaching the Applied Intelligence Stage

The report notes that most insurers have yet to crack the code about how best to apply AI and other intelligent technologies within their organizations. Many are either still educating themselves or experimenting with AI prototypes that could help improve their efficiency or customer outcomes. Few have entered the crucial stage, known as applied intelligence, which is the implementation of technology and human ingenuity across all parts of their core business in pursuit of new forms of growth.

According to the report, reaching the applied intelligence stage requires dedicated leadership at the C-suite level and a cross-enterprise strategy with long-term budgeting. To prepare the insurance workforce for this stage executives must: reimagine work to better understand how machines and people can collaborate; pivot their employees to areas that create new forms of value; and teach new skills that will enable employees to work effectively alongside intelligent machines.

New Roles for the Insurance Workforce

The use of AI will reconfigure many existing jobs within insurance, and the report identified three new categories of AI-driven jobs likely to emerge: “trainers,” “explainers,” and “sustainers.”

- Trainers will assist computers as they learn – for example, to recognize faces or identify images in photographs taken by drones – and play key roles in underwriting, claims and customer engagement. They will work with the systems to ensure that the algorithms accomplish their tasks in the manner and with the outcomes required.

- Explainers will play a vital communications role, interpreting the results of algorithms to improve transparency and accountability for their decisions. If AI rejects a customer’s insurance claim or offers a settlement, insurance workers can help dispel the “black box” perception of AI, helping to strengthen acceptance of AI among customers and regulators.

- Sustainers will ensure that machines stay true to their original goals without crossing ethical lines, including drifting away from desired outcomes or reinforcing bias. Insurers might need to hire ethics compliance managers to ensure that an AI-powered claims assessment system does not discriminate against certain categories of customer.

“As more insurers look to integrate AI within their organizations, they should pursue a large-scale application in which humans and AI work together across a variety of tasks,” said Andrew Woolf, the Talent & Organization lead within Accenture’s Financial Services practice. “The benefits — including faster underwriting, quicker claims settlement and improved customer service — could be extraordinary, helping insurers solve complex challenges, break into new markets and generate new revenue streams.”

The full report can be found here: www.accenture.com/futureinsuranceworkforce

Methodology

Accenture combined quantitative and qualitative research techniques to analyze the attitudes and readiness of workers and business leaders with regards to collaborating with intelligent technologies. The research program included a survey of 100 senior insurance executives and a survey of 919 non-executive insurance workers across skill levels, which were conducted between September and November 2017 in 11 countries: Australia, Brazil, China, France, Germany, India, Italy, Japan, Spain, the U.K. and the U.S. The research also included economic modelling to determine the correlation between AI investment and financial performance.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With approximately 442,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

# # #

Contact

Michael McGinn

Accenture

+1 917 452 9458

[email protected]