April 13, 2016

Global Fintech Investment Growth Continues in 2016 Driven by Europe and Asia, Accenture Study Finds

First-quarter global fintech investment grew 67 percent year-over-year to $5.3 billion; 62 percent of investments went to ventures in Europe and Asia

LONDON; April 13, 2016 – Global investment in financial technology (fintech) ventures in the first quarter of 2016 reached $5.3 billion, a 67 percent increase over the same period last year, and the percentage of investments going to fintech companies in Europe and Asia-Pacific nearly doubled to 62 percent. These are among the findings of a new report by Accenture (NYSE:ACN) analyzing global fintech trends. (Full report: www.fintechinnovationlablondon.co.uk/fintech-evolving-landscape.aspx)

“The drive for fintech innovation is spreading well beyond traditional tech hubs,” said Richard Lumb, Accenture’s group chief executive – Financial Services. “New frontiers like robotics, blockchain and the Internet of Things are bound less by geography than by the industry’s ability to adopt and scale clever ideas that improve service and efficiencies. The so-called ‘Fourth Industrial Revolution’ is a global phenomenon that brings new innovation and digital companies that compete and collaborate with traditional financial services. Bank customers stand to gain from this.”

‘Disruptive’ vs. Collaborative

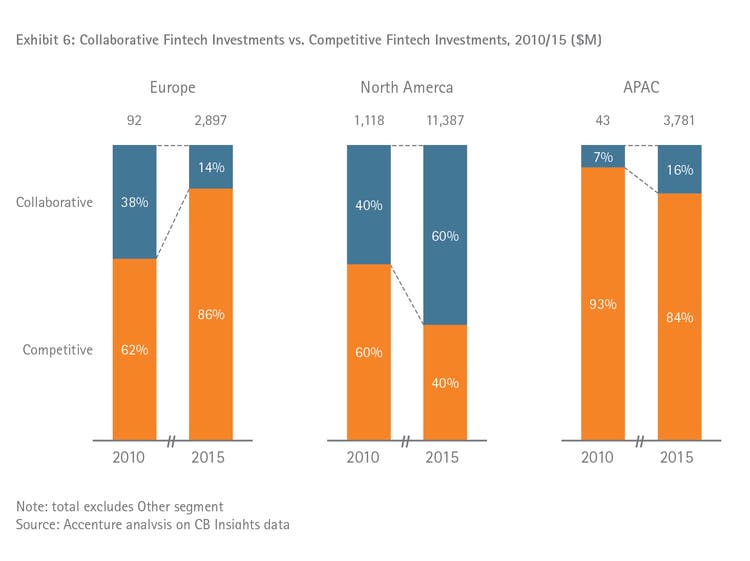

According to the report, collaborative fintech ventures – those primarily targeting financial institutions as customers – are gaining ground over so-called “disruptive” players that enter the market to compete against those institutions.

Funding for collaborative fintech ventures, which accounted for 38 percent of all fintech investment in 2010, grew to 44 percent of funding in 2015, with the remaining investments made in ventures that compete with financial institutions. During that six-year period, the percentage of funding for collaborative fintech ventures in North America rose even more dramatically, from 40 percent to 60 percent. In Europe, however, the reverse was true: Funding for “disruptors” there rose from 62 percent of all fintech investments in 2010 to 86 percent in 2015.

“The proportion of competitive fintech ventures in Europe and Asia is much higher than in North America, which largely reflects the earlier stages of maturity of fintech markets, particularly outside of London,” said Julian Skan, a managing director in Accenture’s Financial Services group who oversees the FinTech Innovation Lab London. “London’s welcoming regulatory environment has made a preferred market for competitive fintech ventures to test their propositions. Banks too stand to benefit from this, as it drives momentum to re-imagine their own capabilities.”

According to the report, so-called “disruptors” may compete against banks at first, but often end up aligning with them through investments, acquisitions and alliances, such as BBVA’s recent stake in Atom, a mobile-only bank developed in London that launched last week.

But while a growing proportion of collaborative fintech ventures have emerged, the report cites “relatively low participation” in venture-investing by the banks themselves, which in 2015 invested $5 billion of the $22.3 billion of reported investments. That compares to an estimated $50 billion to $70 billion that banks spend on internal fintech investment each year, according to the report.

“Banks that excel in assessment and adoption of external fintech disruptions, be they collaborative or competitive, can leapfrog the competition by providing the kinds of digital innovations that consumers have grown to expect from retail and technology giants,” Skan added.

Global Fintech Investment Grew 75 percent in 2015, Exceeding $22 Billion

The report shows that global fintech investment in 2015 grew 75 percent, or $9.6 billion, to $22.3 billion in 2015. This was driven by relatively moderate growth in the US fintech sector – the world’s largest – which received $4.5 billion in new funding (a 44 percent increase); rapid growth in China’s fintech sector which increased 445 percent to nearly $2 billion, as well as in India ($1.65 billion), Germany ($770 million) and Ireland ($631 million).

- In Europe, overall fintech investment more than doubled (120 percent) between 2014 and 2015 and the number of deals increased by half (51 percent). Investment in German fintech ventures grew 843 percent in that period.

- In Asia-Pacific, fintech investment more than quadrupled in 2015 to $4.3 billion. The lion’s share of those investments took place in China ($1.97 billion) and India ($1.65 billion). In the first three months of 2016, APAC investments increased by 517 percent compared to the same period last year – $445 million to $2.7 billion – driven almost entirely by Chinese fintech investments.

- North American fintech investment grew 44 percent to $14.8 billion in 2015 and the U.S. continued to dominate the sector with 667 fintech deals, a 16 percent increase.

- The report also identified a growing number of “big ticket” deals in the global fintech sector, as it begins to mature. In 2015, there were 94 fintech deals larger than $50 million, compared to 52 in 2014 and just 15 in 2013.

Read the full report at http://www.fintechinnovationlablondon.co.uk/fintech-evolving-landscape.aspx

Learn more about Accenture Financial Services at www.accenture.com/FinancialServices

Methodology

The study is based on Accenture’s analysis of fintech investment-data from CB Insights, a global venture-finance data and analytics firm. The analysis included global financing activity from venture capital and private equity firms, corporations and corporate venture-capital divisions, hedge funds, accelerators, and government-backed funds. The data ranged from 2010 through Q1 2016. Fintech companies are defined as those that offer technologies for banking and corporate finance, capital markets, financial data analytics, payments and personal financial management.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With approximately 373,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us atwww.accenture.com.

# # #

Contacts:

Petra Shuttlewood

Accenture

+ 44 7788 305373

[email protected]

Melissa Volin

Accenture

+ 1 267 216 1815

[email protected]

Lara Wozniak

Accenture

+ 1 852 6027 3966

[email protected]