February 13, 2020

Cybersecurity Is Now the Top Focus of Upstream Oil and Gas Companies’ Digital Investments, According to Research from Accenture

Yet upstream businesses are struggling to scale digital technologies and unlock additional value

NEW YORK; Feb. 13, 2020 – Cybersecurity has emerged as the top focus of upstream oil and gas companies’ digital investments, according to a new report from Accenture (NYSE: ACN).

The “Accenture Upstream Oil and Gas Digital Trends Survey 2019,” the seventh edition of Accenture’s report on digital technologies in the upstream oil and gas industry, is based on a global survey of 255 industry professionals, including C-suite executives, functional leaders and engineers.

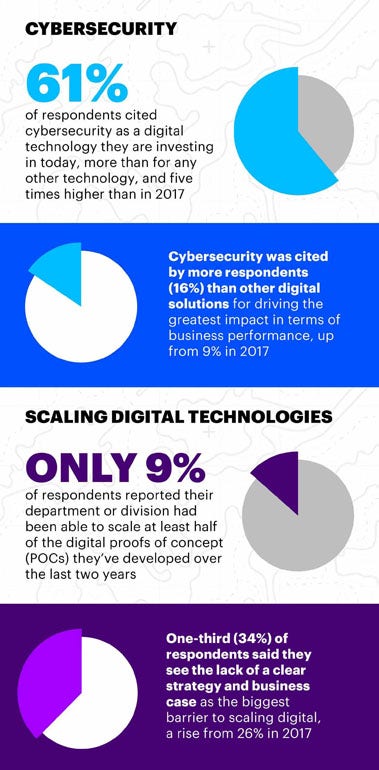

When respondents were asked which digital technologies their organizations are investing in today, cybersecurity was cited more than any other, by 61% of respondents — five times higher than the 12% who made that claim in 2017. The report suggests that the focus on cyber resilience is increasing sharply as oil companies seek to protect their assets and reputations.

Cybersecurity was also cited by more respondents (16%) than any other digital solutions when asked which were driving the greatest impact in terms of business performance, up from 9% in 2017.

With their increased investments in cybersecurity today, only 5% of respondents see increased vulnerability to cyberattacks as the biggest risk from a lack of investment in digital — less than one-third the number (18%) who made this claim in 2017. This might explain why only 35% of respondents plan to invest in cybersecurity over the next three to five years.

“As oil companies’ operations come under increasing threat, cyber resilience becomes more important to stakeholders, consumers and government,” said Rich Holsman, a managing director at Accenture who leads the digital practice in the company’s Resources operating group. “Managing attacks isn’t just a matter of protecting reputation, share price and operations, but it’s part of a greater responsibility for national services and security. Upstream businesses must continue to invest thoughtfully and substantially in cybersecurity measures, as they often underestimate their exposure to such attacks, which are also increasing in technical complexity.”

The survey identified cloud technologies as the second-biggest focus for digital investment, cited by more than half (53%) of companies. In fact, 15% of respondents identified cloud technologies as the digital solutions driving the greatest business performance impact. The report suggests that oil and gas companies are still investing heavily in cloud technologies because they are a foundation for their digital transformational journeys and for greater operational security.

Additionally, the percentage of respondents who cited artificial intelligence (AI) as driving the greatest business performance impact more than doubled from 2017, from 4% to 9%.

As such, when asked what digital technologies they plan to invest in over the next three to five years, the greatest number (51%) cited AI / machine learning — up from 30% in 2017 — followed by big data / analytics (50%), the internet of things (43%) and mobile / wearable technologies (38%). Almost half (47%) of respondents cited a loss of competitive advantage as the biggest risk of a lack of investment in digital, with 42% citing cost reduction as the most significant business challenge that digital can help address.

Broadly however, the rate of digital investment by upstream companies has remained almost the same over the last few years. For instance, the number of executives who said their companies plan to invest more or significantly more in digital technologies over the next three to five years — 72% — was relatively unchanged from the number of who responded similarly to the same question in the 2017 survey (71%).

Scaling digital technologies is key to generating value from digital investments

The report reveals that upstream oil and gas companies are finding it hard to scale digital initiatives. Only 9% of respondents reported that their department or division had been able to scale at least half of the digital proofs of concept (POCs) they’ve developed over the last two years. Further, only one in five respondents (20%) said that they were able to scale more than 20% of their POCs past this pilot stage.

The report also notes that while upstream companies need to scale digital technologies to release trapped value — i.e., to generate added value from their digital investments — significant barriers remain to doing so.

For instance, one-third (34%) of respondents said they see the lack of a clear strategy and business case as the biggest barrier, up from 26% in 2017. Further, only one in seven respondents (15%) said they are seeing more than US$50 million in additional value from their digital investments, and only one in 20 (5%) said that digital is adding at least US$100 million in value to their upstream business, a drop from 12% only two years ago.

“Although upstream companies continue to increase their digital investments, they’re not translating those investments optimally into tangible value — in fact, their ability to generate value from digital seems to be declining,” Holsman said. “These companies face organizational bottlenecks and are finding it hard to scale these technologies, impeding core business transformation and the release of capital. Realigning digital investments and building the right operating model and digital capabilities is needed for oil companies to become agile and able to scale to value. This will require not only more support from leadership, but also a much broader ecosystem of partnerships as well.”

Research Methodology

The Accenture Upstream Oil and Gas Digital Trends Survey 2019 was conducted online by PennEnergy Research in partnership with the Oil & Gas Journal between March and May 2019. The survey comprised 255 respondents from 47 countries, who included C-level executives, vice presidents, business unit leads, mid-level management, information technology professionals, engineers and project managers from a cross section of national oil companies, international oil companies, independent oil companies and oilfield services companies. The final results and analysis were supported by Accenture Research.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions — underpinned by the world’s largest delivery network — Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With 505,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

# # #

Contacts:

Guy Cantwell

Accenture

+1 281 900 9089

[email protected]

Matt Corser

Accenture

+44 755 784 9009

[email protected]

Copyright © 2020 Accenture. All rights reserved. Accenture and its logo are trademarks of Accenture. The information in this press release and the “Accenture Upstream Oil and Gas Digital Trends Survey 2019” is general in nature and does not consider the specific needs of your IT ecosystem and network, which may vary and require unique action. As such, all information is provided on an “as-is” basis without representation or warranty, and the reader is responsible for determining whether to follow any of the suggestions, recommendations or potential mitigations at their own discretion. Accenture accepts no liability for any action or failure to act in response to the information contained or referenced in this press release or the mentioned report.