August 12, 2020

Almost Half of Chemical Companies Fear Losing Markets Due to Not Meeting Customers’ Needs, New Research from Accenture Shows

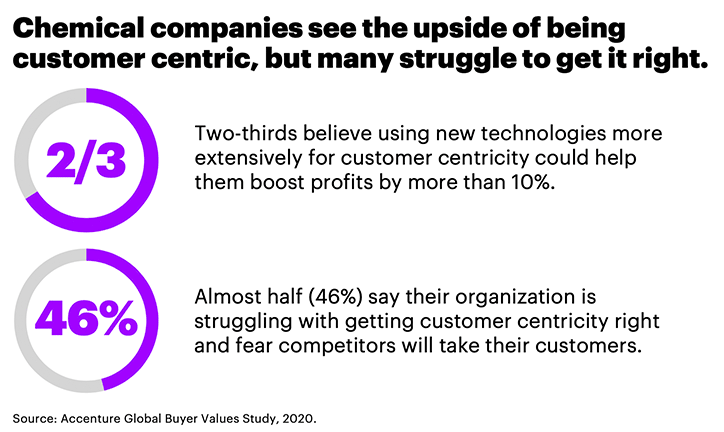

But two-thirds say getting customer centricity right can boost profits by more than 10%

NEW YORK; August 12, 2020 – Despite seeing customer centricity ― i.e., the ability to anticipate and meet customer needs ― as a top priority, nearly half (46%) of chemical companies/suppliers say they’re struggling to get it right and fear competitors will take their customers, according to new research from Accenture (NYSE: ACN).

At the same time, two-thirds (66%) of chemical suppliers said using new technologies more extensively to get customer centricity right could help them boost profits by more than 10%, and approximately one-third (35%) said it could help them increase profits by more than 20%.

The Accenture Global Buyer Values Study― based on surveys of 2,205 materials companies, industrial buyers, retailers and consumers ― found that chemical suppliers’ fears about losing customers to competitors are well-founded, as most buyers have options. Just over half of buyers (55%) said they could switch to alternate materials, including materials from providers outside the chemical industry, for example using metals instead of plastic.

According to the study, the risk of customer defection could be compounded by differences between what buyers and consumers want and what chemical companies think they want. For instance:

- When asked to rank the most important product characteristics related to sustainability, consumers and buyers cited safer materials and durable products. But chemical companies thought these stakeholders would say that renewable energy and recyclable products were most important.

- Chemical companies ranked “value-added services” higher than buyers did, which suggests they are prioritizing services that buyers don’t fully value. This is particularly troublesome for chemical companies, since they see value-added services as a path to differentiation.

- Buyers and consumers ranked logistics and delivery reliability of higher importance than chemical companies expected they would.

“We also found a notable difference between how chemical companies and buyers evaluate relationship building,” said Bernd Elser, a managing director at Accenture who leads its Chemical industry practice globally. “Buyers placed a higher value on digital interfaces and experiences that make it easier and more intuitive to interact. This implies that chemical companies have an opportunity to improve customer relationships through the effective use of technology.”

The findings reveal that nearly all chemical companies (99%) are using at least one new technology, for instance, analytics or robotics, to be more customer centric. However, doing so requires good data, and approximately three-fourths of chemical companies (74%) said they face data-related challenges — either too much, too little, unusable or poor-quality data. These insights and others on customer centricity were corroborated during a virtual panel at this year’s American Chemistry Council Annual Meeting.

“As part of our customer-experience efforts, we use data to help us establish correlation and then ultimately causation between the services we want to invest in ― and evolve ― and the financial outcomes of our customers,” said Dan Futter, Dow’s chief commercial officer, who spoke on the panel. “We have put in a lot of work on that at Dow, trying to understand those correlations. We hope to bring much better data into discussions around prioritizing investments in customer experiences over more traditional investment areas.”

Sucheta Govil, Covestro’s chief commercial officer and another panelist, noted that being a product-centric company is no longer enough and that driving a customer-centric culture is key.

“This enables you to better map decision journeys, build stronger relationships and work with customers to identify joint outcomes for which you want to solve,” Govil said. “Circularity is a case in point in the chemical industry, as are emissions. The value of customer centricity is clear. However, it’s up to us to structure, document and make the benefits easily digestible and available.”

Research Methodology

The purpose of Accenture’s Global Buyer Values Study was to evaluate customer centricity within the chemical industry by identifying what customers need and how well chemical companies are meeting those needs. A two-part methodology was employed that included 1) a preference analytics tool that ranked 74 buyer values across 14 defined attributes and 2) a standard survey. The study comprised two separate respondent groups: one of 345 executives at materials suppliers (approximately 100 of which were chemicals/plastics suppliers), 760 industrial buyers (across 15 sectors) and 100 retailers; and another of 1,000 consumers to gain insight into end-user buying preferences that could ultimately affect the chemical industry. The 12 countries represented in the study included: Brazil, Canada, China, France, Germany, India, Japan, Netherlands, South Korea, Spain, the United Kingdom and the United States.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services in strategy and consulting, interactive, technology and operations, with digital capabilities across all of these services. We combine unmatched experience and specialized capabilities across more than 40 industries — powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. With 513,000 people serving clients in more than 120 countries, Accenture brings continuous innovation to help clients improve their performance and create lasting value across their enterprises. Visit us at www.accenture.com.

# # #

Contact:

Guy Cantwell

Accenture

+1 281 900 9089

[email protected]

Matt Corser

Accenture

+44 755 784 9009

[email protected]