August 04, 2015

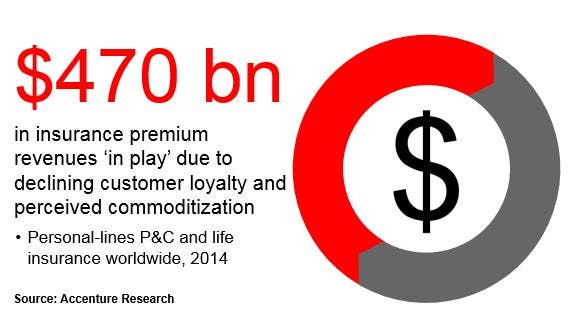

$470 Billion in Insurance Premiums Up for Grabs Due to Declining Customer Loyalty and Perceived Product Commoditization, According to Accenture Report

‘Switching Economy’ grows as less than one-third of insurance customers satisfied with current provider

NEW YORK; August 4, 2015 – As much as $470 billion in life insurance and property & casualty insurance premiums will be up for grabs globally as a result of declining customer loyalty and the perceived commoditization of products, according to a new report from Accenture (NYSE: ACN).

The Accenture Strategy report – Capturing the Insurance Customer of Tomorrow – is based on Accenture’s Global Consumer Pulse Research, which included more than 13,000 P&C and life insurance customers in 33 countries. The survey found that less than one-third (29 percent) of insurance customers are satisfied with their current providers. At the same time, the number of customers who believe that most insurance carriers are the same in terms of their products and services jumped 50 percent in the last year, to 21 percent in this year’s survey from 14 percent in a similar survey last year.

Furthermore, less than one in six customers (16 percent) said they would definitely buy more products from their current insurance provider. In addition, only one in four (27 percent) has a high estimation of their insurance providers’ trustworthiness, and nearly one in four (23 percent) said they would consider buying insurance from online service providers, including technology giants.

“Today’s insurance customer is more empowered, more social and has higher expectations of his/her providers,” said John Cusano, senior managing director of Accenture’s global Insurance practice. “The study data indicates insurers are not keeping up with rising customer expectations, leading to increased customer dissatisfaction with insurance providers. This has created a ‘switching economy,’ which threatens traditional insurers by giving the advantage to companies most successful at exploiting digital technologies.”

Nearly half (47 percent) of the survey respondents said they want more online interactions with their insurers. In the past six months, half (49 percent) of P&C consumers purchased a policy online, with two in five (41 percent) using a mobile phone to make the purchase. The percentages are even higher for customers in emerging markets, with 57 percent of P&C consumers there purchasing a policy online, and more than two-thirds (69 percent) of those using a mobile phone to make that purchase. While many consumers globally are using online tools to purchase insurance products, only 15 percent said they are satisfied with their insurers’ digital experience.

“Leading insurers realize the need to offer a broader range of innovative products and services and create a differentiated customer experience, which will likely require partnering with nontraditional players,” added Jean-Francois Gasc, managing director, Insurance, Accenture Strategy, Europe, Africa and Latin America. “As a result, traditional insurance providers face a stark choice: embrace digital and customer-centricity, or become a highly efficient manufacturing utility, leveraging capital and digital technologies to provide low-cost insurance product manufacturing and servicing. Those who do neither are likely to lose out in this switching economy.”

Methodology

The Accenture Global Consumer Pulse Research is an annual project that assesses consumer attitudes toward the customer experience – including marketing, sales and customer service practices – and consumers’ behaviors in response to companies’ practices. For the most-recent report, Accenture surveyed more than 23,000 respondents, including 6,521 P&C insurance customers and 6,507 life insurance customers in 33 countries. The survey was conducted via the Internet in 2014. The findings quoted in this report combine the responses from the P&C insurance customers and the life insurance customers.

About Accenture

Accenture is a global management consulting, technology services and outsourcing company, with more than 336,000 people serving clients in more than 120 countries. Combining unparalleled experience, comprehensive capabilities across all industries and business functions, and extensive research on the world’s most successful companies, Accenture collaborates with clients to help them become high-performance businesses and governments. The company generated net revenues of US$30.0 billion for the fiscal year ended Aug. 31, 2014. Its home page is www.accenture.com.

Accenture Strategy operates at the intersection of business and technology. We bring together our capabilities in business, technology, operations and function strategy to help our clients envision and execute industry-specific strategies that support enterprise wide transformation. Our focus on issues related to digital disruption, competitiveness, global operating models, talent and leadership help drive both efficiencies and growth. For more information, follow @AccentreStrat or visit www.accenture.com/strategy.

# # #

Contact:

Melissa Volin

Accenture

+1 267 216 1815

[email protected]