January 26, 2022

Accenture Named a Leader in Platform IT Services for both Banking and Capital Markets by Everest Group

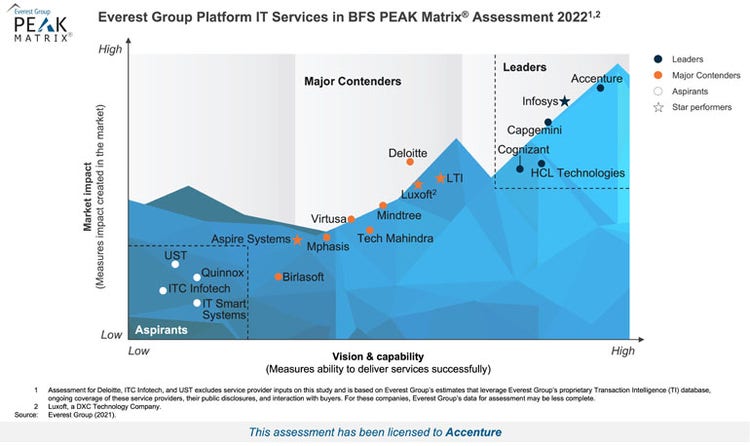

NEW YORK; Jan. 26, 2022 – Accenture (NYSE: ACN) has, for the second consecutive time, been named a Leader in platform IT services for banking and capital markets in a report by industry analyst firm Everest Group.

In the report, titled “Platform IT Services in BFS PEAK Matrix® Assessment 2022,” Accenture is positioned as a Leader for both Market Impact, which assesses service providers against criteria such as market adoption, portfolio mix and value delivered to clients; and Vision & Capability, which measures firms’ strategy, scope of services, innovation & investments, and delivery.

The report notes that many banks and capital markets firms are focused on upgrading and modernizing their core systems, partnering with a mix of technology platforms and service vendors to fill gaps in their digital capabilities.

According to Everest Group, Accenture is well-positioned to help financial services clients adopt enterprise platforms through its end-to-end platform service framework, long-standing partnerships with banking and capital markets platforms, and significant investments to bolster its capabilities, including centers of excellence, innovation labs and intellectual property.

“Banking and capital markets clients have appreciated Accenture’s strategic partnership as they move along their platform journey from selection to migration and implementation,” said Ronak Doshi, a partner at Everest Group. “Accenture’s long-standing partnerships with several core, workflow, risk & compliance, and customer experience platforms; coupled with its strategic acquisitions to fuel its talent pool; investments in next generation technology; and a well-balanced delivery footprint; have made it a Leader in Everest Group’s Platform IT Services in BFS PEAK Matrix® Assessment 2022.”

Brett Goode, who leads Accenture’s digital banking practice in North America, said, “As the demand for digital services increases, platforms can help banks operate more flexibly, make better use of their data, and create new products faster to improve the customer experience. We are thrilled to be recognized by Everest Group as a Leader in this space, where we use our deep industry knowledge, technology capabilities and strong ecosystem of leading platforms to support banks in offering the next generation of banking solutions to their customers.”

Tom Syrett, who leads Accenture’s capital markets platforms business, said, “We’ve supported some of the largest migrations within the industry, leveraging our DevOps and cloud capabilities to enable capital markets firms to integrate and manage platforms faster, better and more cost-effectively. Moving these platforms to the cloud can unlock added benefits, including increased agility and access to advanced analytics capabilities.”

Everest Group’s Platform IT Services in BFS PEAK Matrix® Assessment 2022 analyzed 18 service providers on several capability-related dimensions. The study is based on RFI responses from service providers, client reference checks and an ongoing analysis of the IT platforms banking and financial services market.

More information on the assessment can be found here.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 674,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at accenture.com

Accenture’s Banking industry group helps retail and commercial banks and payments providers boost innovation; address business, technology and regulatory challenges; and improve operational performance to build trust and engagement with customers and grow more profitably and securely. To learn more, visit https://www.accenture.com/us-en/industries/banking-index

Accenture’s Capital Markets industry group helps wealth and asset managers, investment banks and exchanges rethink their business models, manage risk, redefine workplace strategies and improve operational efficiency to prepare for the digital future. To learn more, visit https://www.accenture.com/us-en/industries/capital-markets-index

# # #

Contacts:

Michael McGinn

Accenture

+1 312 693 5707

[email protected]

Susan Kirwin

Accenture

+1 416 641 5148

[email protected]

Copyright © 2022 Accenture. All rights reserved. Accenture and its logo are trademarks of Accenture.

This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors. This document refers to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied.