February 12, 2018

Insurers That Transform their Businesses and Operating Models Could See US$375 Billion in New Revenue Growth, Accenture Analysis Finds

NEW YORK; Feb. 12, 2018 – Insurance carriers globally could seize US$375 billion in new revenue in the next five years by transforming and revitalizing their businesses. according to a new report from Accenture (NYSE: ACN).

The report, “Insurance as a Living Business,” finds that insurers that continuously innovate and adapt to changing customer needs will be able to capture emerging growth opportunities and outperform competitors.

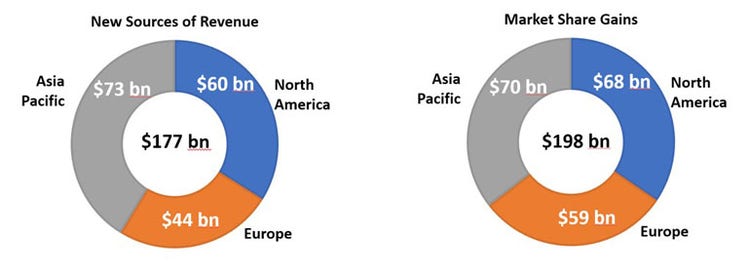

The report estimates that these insurers could, in aggregate, generate an additional US$177 billion in revenue from five key areas: emerging risks like cyber security and autonomous vehicles; improved penetration of markets that until now have been difficult to profit from; value-added services that help reduce customers’ risk, such as connected devices in homes to detect maintenance issues before they cause damage; expanded business partnerships, both within and outside of insurance, to create more-personalized offerings for consumers; and the monetization of assets such as data, platforms and algorithms.

Another US$198 billion in new revenue represents the potential shift in market share within the five key areas, favoring insurers who embrace transformation at the cost of less-responsive competitors.

According to the report, innovating and adapting to changing customer needs will require insurers to develop more-fluid talent pools, streamline legacy infrastructure, use data and analytics to personalize their services more effectively, and create a vigorous leadership team and organizational culture that are open to new ideas and approaches.

“The insurance industry as we know it is at the edge of a new business environment,” said Michael Costonis, who leads Accenture’s Insurance practice globally. “Breaking away from the pack and capturing new revenue opportunities requires a shift in business mindset – a shift from product-focused to customer-focused; from rigid operating models to more fluid and agile operating models that respond quickly to customer preferences; and from going to market alone to partnering with insurtechs and technology behemoths that can help them reach new customer segments and reinforce their brand.”

Projected Revenue Opportunities

The report recommends several steps that insurers can take to amplify growth opportunities. These include developing an enterprise-wide digital strategy that embraces new models and new technology – including artificial intelligence, blockchain, smart contracts and the internet of things – to offer more-personalized and faster services, and harnessing the treasure trove of customer data already in their possession to better customize their offerings.

In addition, the report identifies five areas for revenue growth where insurance carriers – across property and casualty, life and commercial lines – could either launch new products and services or increase the reach of those they already sell.

- Targeting hard-to-reach market segments in new, more effective ways. As new channels (online, mobile) and technologies (analytics, geo-location) proliferate, insurers can tap into harder-to-reach segments, like micro insurance or instant issue for life insurance, to grow market share cost-effectively. The could generate US$144 billion in new revenue.

- Opportunities from new risks. Insurers should develop new offerings that address emerging risks, such as cyber insurance and new commercial exposure brought about by the advent of autonomous vehicles. This could generate US$111 billion in new revenue.

- Non-traditional intermediary roles and ecosystems. Business relationships with insurtech startups and organizations outside the insurance industry can enable insurers to engage differently with customers and discover new sources of customer value. This includes plugging into existing ecosystems operated by online platform companies such as Google, Amazon, Facebook and Apple to connect with consumers who are already taking advantage of their platforms, including virtual assistants. This approach could generate US$80 billion in new revenue. According to the report, three-quarters (76 percent) of the new revenues in property and casualty lines are likely to come from these non-traditional relationships.

- Monetization of data platforms and models. Insurers can offer their assets – data, customer insights, platforms and models as services, risk algorithms, etc. – to ecosystem partners who would benefit from them. Doing so could generate US$28 billion in new revenue.

- Value-added services. Insurers should focus on personalized services that help reduce customers’ risks, such as the use of wearables to help aging relatives stay at home longer, and selling and managing connected home devices. This could generate US$12 billion in new revenue.

“Maintaining the business status quo is unsustainable,” Costonis said. “Insurers’ profits and revenues are under pressure as insurtech startups proliferate and technology companies with strong personalized customer relationships circle the industry. Innovation – beyond aggregators and online distributors – must be an industry priority. Carriers that make the right business changes, understand their customers, and respond to them rapidly and fearlessly with relevant, innovative offerings will be more likely to increase market share and capitalize on the new emerging opportunities.”

About the Research

Using an international team of insurance analysts and market experts, Accenture Research conducted an intensive market scan of nine major economies (the U.S., the U.K., France, Germany, Italy, Spain, Japan, China and Australia) and identified a total of 23 future growth levers, which were grouped into the five categories described in this report. Using a common methodology that included conservative, moderate and aggressive scenarios, and drawing on input from clients, each of the local teams then analyzed the future impact of each growth lever. Their forecasts – which included estimates of future market-share shifts – were aggregated into regional and global totals.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With more than 435,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

# # #

Contact:

Michael McGinn

Accenture

+1 917 452 9458

[email protected]