September 14, 2016

Majority of Businesses and Economies Are Not Ready for Digital Platforms, Accenture Research Shows

China, India and the US to dominate the global platform economy; much of Europe lags

NEW YORK; Sept. 13, 2016 – Research released by Accenture (NYSE: ACN) reveals that despite the potential for small and traditional businesses to become successful digital platform companies, as few as 10 percent of new start-ups focused on digital platform business models will become profitable independent entities in the coming years. The analysis also reveals that China, India and the U.S. will dominate the platform economy by 2020, and that the gulf between countries will increase. To help bridge this gap, the report outlines five critical steps businesses and governments can take to succeed.

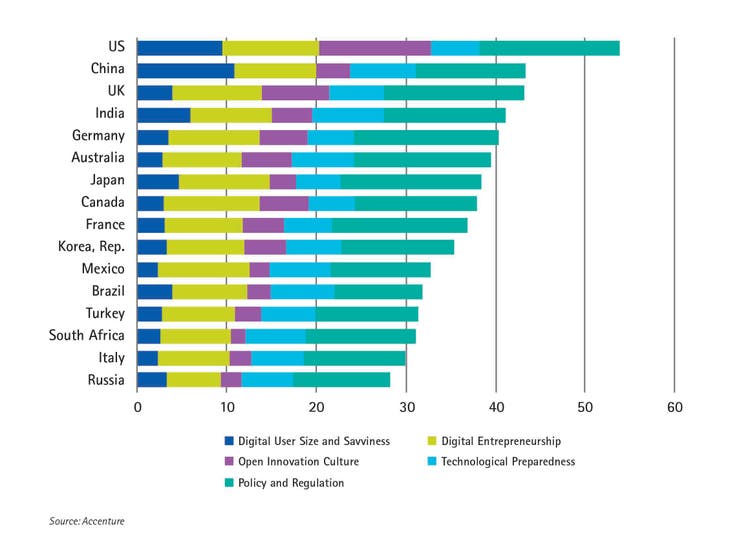

Accenture’s report Five Ways to Win with Digital Platforms, published in collaboration with the G20 Young Entrepreneurs’ Alliance, assesses the ability of 16 G20 economies to support the flourishing of digital platforms. It shows that the UK and Germany join China, India and the U.S. at the top of the Accenture Platform Readiness Index (see figure 1), but other emerging markets and European economies are predicted to lag behind, lacking sufficient business and socio-economic enabling conditions.

Figure 1: Accenture Platform Readiness Index

“When you think of digital platforms, think of China and India as much as the U.S. These economies are using the power of platforms to create large scale markets very rapidly,” said Paul Daugherty, chief technology officer, Accenture. “Many European economies are in danger of missing out in the platform economy. Multi-stakeholder cooperation is required to address the fragmented digital markets and to support the greater levels of digital enterprise and consumption that successful platform businesses need.”

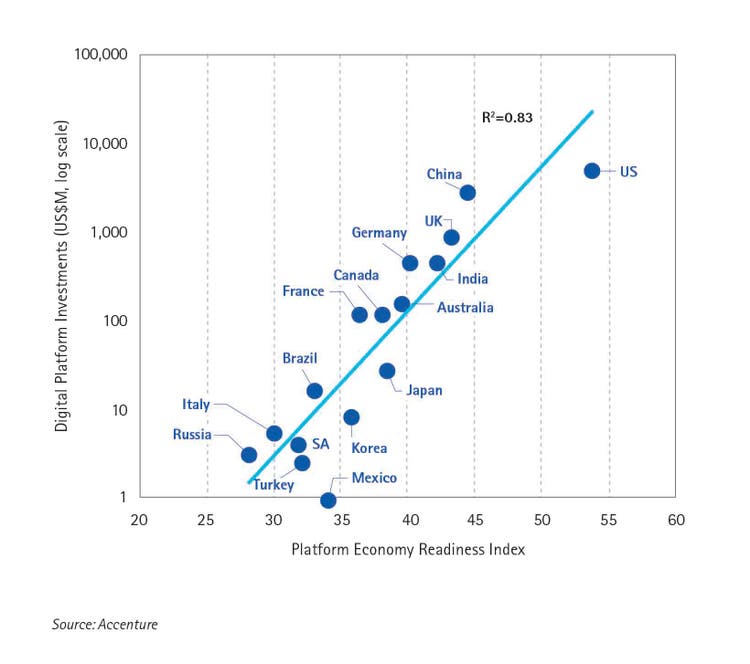

Accenture’s analysis shows $20bn was invested in digital platforms between 2010 and 2015 in 1,053 publicly announced deals. More than half of this investment took place between 2014 and 2015. It also shows that rankings on the Platform Readiness Index strongly correlate to the levels of digital platform activity and investment in G20 countries (see figure 2).

Figure 2: Platform readiness and platform investment are strongly correlated

The report recommends that governments engage with businesses leaders to advance a range of policies that can create a rich enabling environment for digital platforms including the following actions:

- Prioritize data protection standards and rules: Drive the harmonization of data privacy and data security legislation. Smooth cross-border data transfers.

- Design regulations with digital platforms in mind: Experiment with regulations alongside new technologies and business models. For instance, the U.K.’s Financial Conduct Authority’s “regulatory sandbox” allows start-ups to test ideas without immediately incurring all the normal regulatory consequences.

- Encourage cross-border electronic trade. Harmonize taxes and standards, consumer protection, contract laws and logistics infrastructure. The eWorld Trade Platform (eWTP), initiated by B20 China, aims to accelerate international policy collaboration to support SMEs.1

- Invest in digital infrastructure: For example, the E.U.’s Payment Services Directive (PSD2) will empower start-ups to expand customer reach and encourage innovative business models.

- Think small, act big: Educate SMEs on alternative funding, such as crowdfunding and peer-to-peer lending; and on data privacy and consumer protection. Support SMEs with digital economic zones to support e-commerce.

Five ways to succeed

Accenture notes that only 15 percent of Fortune 100 companies have developed digital platform business models to date Successful digital platforms will proliferate as small businesses and traditional industries follow the lead set by digital-born platform companies. Accenture identifies five factors critical to sustaining critical mass in digital platforms, which use new technologies to create large scale markets of customers and service providers:

- Proposition: Create differentiated platform services that extend beyond the point of transaction; and that support both customers on the demand side and service providers on the supply side.

- Personalization: Target customers through tailored experiences across all channels, using customer data to anticipate needs and offer bespoke experiences.

- Price: Apply new pricing models, such as pay-as-you-go, ‘freemiums’, and subscription pricing to respond to peak demand.

- Protection: Embed trust at the heart of the platform, using both prevention and compensation techniques to attract customers and differentiate the platform.

- Partners: Scale the platform rapidly by identifying digital partners – such as app developers and payment service providers – who can enrich the platform experience and fulfil customer needs.

“Digital platforms are not just the preserve of digital born companies, like Airbnb and Alibaba, but are now becoming a default business model in most industry sectors, both B2B and B2C,” said Francis Hintermann, managing director, Accenture Research. “To enjoy efficiencies and high rates of growth, companies will need to transform everything from the way they co-create goods and services with third parties, tailor their offerings to customers, and price them dynamically. Crucially, they will only sustain critical mass by working with digital partners who can deliver the range of functional services that complete the customer experience.”

About the Accenture Platform Readiness Index

The Accenture Platform Readiness Index measures 16 G20 countries by a number of factors including the size and savviness of their digital population, the extent of its digital talent and the strength of its wider entrepreneurship culture. Accenture also measured degrees to which companies are willing to share intellectual property and ideas in a spirit of open innovation, the quality of their technology infrastructure and their ability to support home-grown technologies. The agility and flexibility of market regulation on issues such as data privacy, data portability and cybersecurity was also measured.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With more than 375,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

1 Draft policy paper of B20 SME development taskforce, May 2016

# # #

Contact:

Matthew McGuinness

Accenture

+ 1 917 272 7187

[email protected]