March 26, 2013

Nearly Half of U.S. Financial Advisors Now Use Social Media Daily to Interact with Clients, According to Accenture Study

Two-Way Communication May Strengthen Relationships, as Advisors Overestimate Investment Knowledge and Risk Appetite of Clients

NEW YORK; March 26, 2013 – Financial advisors view social media as an increasingly important tool to engage clients, grow their business and better understand clients’ investment goals – with 48 percent interacting daily with clients through social media, according to an Accenture survey of 400 U.S. financial advisors. The survey also revealed that financial advisors significantly overestimate the investment savvy and risk appetite of investors.

According to the survey, published in Accenture’s report “Closing the Gap: How Tech-Savvy Advisors Can Regain Investor Trust,” financial advisors see the rapid adoption of digital technologies changing their relationships with clients and view social media tools as increasingly critical to their individual success. The study shows:

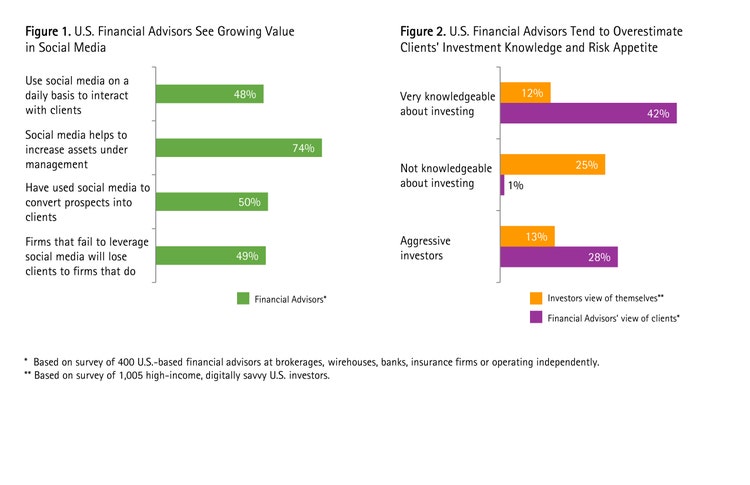

- Nearly half (48 percent) of financial advisors are using social media on a daily basis to interact with their clients – most of whom (60 percent) have assets of more than $20 million.

- Seventy-four percent of advisors believe social media helps them increase assets under management; and half of advisors claim to have successfully used social media to convert prospects into clients.

- Nearly half of advisors (49 percent) said they believe firms that fail to leverage social media will lose clients to firms that do.

“The use of social media to interact with clients is a differentiator for advisors today, but it will be mere table stakes in the not too distant future,” said Alex Pigliucci, global managing director of Accenture Wealth and Asset Management Services. “Wealth management firms that fail to adopt social media will miss an opportunity to build relationships with clients on their terms. This is becoming increasingly critical as investors are demanding online resources to help them better understand investment strategy and advice.”

Advisors Overestimate Clients’ Investment Knowledge and Risk Appetite

The study compares investment perspectives of financial advisors and high-income, digitally savvy investors and examines the client-advisor relationship in light of new technologies. It shows that financial advisors are overestimating the investment knowledge and risk appetite of their clients.

- Advisors are three times more likely to describe their clients as “very knowledgeable” about investing than investors themselves (42 percent vs. 12 percent, respectively).

- One percent of advisors describe their clients as “not knowledgeable” about investing, compared to 25 percent of investors who self-identified this way.

- Advisors are more than twice as likely as investors to see their clients as “aggressive” investors (28 percent vs. 13 percent, respectively).

- Sixty-seven percent of advisors claim to have a “personal relationship” with their clients, whereas only 38 percent of clients view this relationship as “personal.”

“Our research suggests that financial advisors need to focus on better understanding their clients’ views and objectives to foster closer, more trusting relationships,” continued Pigliucci. “With the explosion of ‘self-serve’ digital investment channels and increasingly complex investment products, the importance of this will only grow. Digital and social media tools can help advisors by increasing the frequency and quality of two-way communication with clients.”

“Firms need to implement deliberate social media strategies and provide their advisors with the tools and guidance to make their digital interaction meaningful. This will help create tighter client relationships, increase the firm’s visibility on digital channels and, ultimately, drive business for the institution,” concluded Pigliucci.

Accenture Wealth and Asset Management Services provides management consulting, technology and outsourcing services to financial institutions to optimize analytics for wealth and asset managers, improve advisor productivity, help drive sales, reduce costs and manage risks. Its clients include eight of the top 10 global wealth managers and seven of the top 10 global asset managers.

Methodology

Accenture conducted a broad-ranging body of research to develop insights on how emerging digital and social channels influence relationships between investors and financial advisors, as part of an integrated quantitative and qualitative study, which included surveys of investors and advisors. The survey of advisors included 400 U.S.-based financial advisors, working for at least two years at brokerages/wirehouses/banks (250), or as independents or representatives of regional banks or insurance firms (150). Respondents were made up of 70 percent men and 30 percent women. The survey of investors involved 1,005 high-income, digitally savvy U.S. investors, made up of an even mix of men and women, who are current investors or intend to invest within three years and use social media at least every week.

About Accenture

Accenture is a global management consulting, technology services and outsourcing company, with approximately 259,000 people serving clients in more than 120 countries. Combining unparalleled experience, comprehensive capabilities across all industries and business functions, and extensive research on the world’s most successful companies, Accenture collaborates with clients to help them become high-performance businesses and governments. The company generated net revenues of US$27.9 billion for the fiscal year ended Aug. 31, 2012. Its home page is www.accenture.com.

# # #

Contact:

Melissa Volin

Accenture

+ 267 216 1815

+ 215 990 4647 (mobile)